钛媒体引领未来商业与生活新知-Chinas Viral AI Agent Startup Manus Relocates to Singapore Lays Off Domestic Staff Amid US Tech Restrictions

July 8, 2025 4 min 817 words

这篇报道主要讲述了中国AI初创公司Manus因美国对中国科技限制而将总部迁至新加坡,并裁减了部分国内员工。报道提到,Manus的技术发展受到NVIDIA芯片获取的制约,因此选择海外扩张,以寻求更好的基础设施和资金支持。新加坡因其良好的监管环境和发展潜力,成为了公司新的战略基地。 评论中指出,西方媒体对此类迁移的报道往往充满偏见,可能忽略了科技企业的多元化战略选择。报道强调了美国政策的压力,但未充分展示中国市场的机会与挑战并存。Manus的移动反映了全球科技生态的变化,而这一变化无论是出于生存还是发展需求,都是企业正常的市场行为,不应被简单解读为“失败”或“逃离”。更需关注的是,全球科技的合作与竞争是互联互通而非对立,应该以更全面的视角看待这一现象。

AsianFin -- Manus, the Chinese AI Agent startup that went viral earlier this year, has rapidly shifted its strategic base overseas just four months after its breakout product launch, relocating its global headquarters to Singapore and laying off a significant portion of its China-based workforce.

According to exclusive information obtained by the author on July 8, Beijing Butterfly Effect Technology Co., Ltd., the company behind Manus, has initiated domestic layoffs following the relocation of over 40 core technical employees to Singapore. The company’s headcount in China currently stands at around 120, and employees remaining after the transfer are being offered compensation packages ranging from N+3 to 2N.

Recruitment has already begun in Singapore, with job postings for AI engineers, data scientists, and development managers offering monthly salaries between SGD $8,000 to $16,000 (approximately RMB 110,000), according to people familiar with the matter.

The move comes amid growing geopolitical pressure and restrictions on Chinese access to U.S. AI technologies. A source close to the company confirmed that Manus’s inability to secure cutting-edge NVIDIA chips—critical for training and deploying advanced models—has slowed the development of its intelligent agent systems. These delays reportedly pushed the company to seek infrastructure and funding support abroad.

Benchmark, a top Silicon Valley venture capital firm known for early bets on Uber and Snap, led a $75 million Series B funding round for Manus at a $500 million valuation earlier this year, according to The Information. Investors believe that to continue integrating with leading global AI ecosystems—including OpenAI’s ChatGPT and Anthropic’s Claude—Manus needed to relocate to avoid regulatory and technical bottlenecks tied to its Chinese registration.

Singapore’s Lianhe Zaobao and Nanyang Si Xun both reported that the company’s R&D lead cited U.S. export restrictions as a critical factor in the decision.

The company, whose core product is the Monica.im AI platform, officially registered its Singapore entity in August 2023 under the same English name, “Butterfly Effect.” The entity is wholly owned by a Cayman Islands parent company. Manus is also reportedly planning to open a Tokyo office as part of its broader international expansion strategy into Japan, Southeast Asia, and the Middle East.

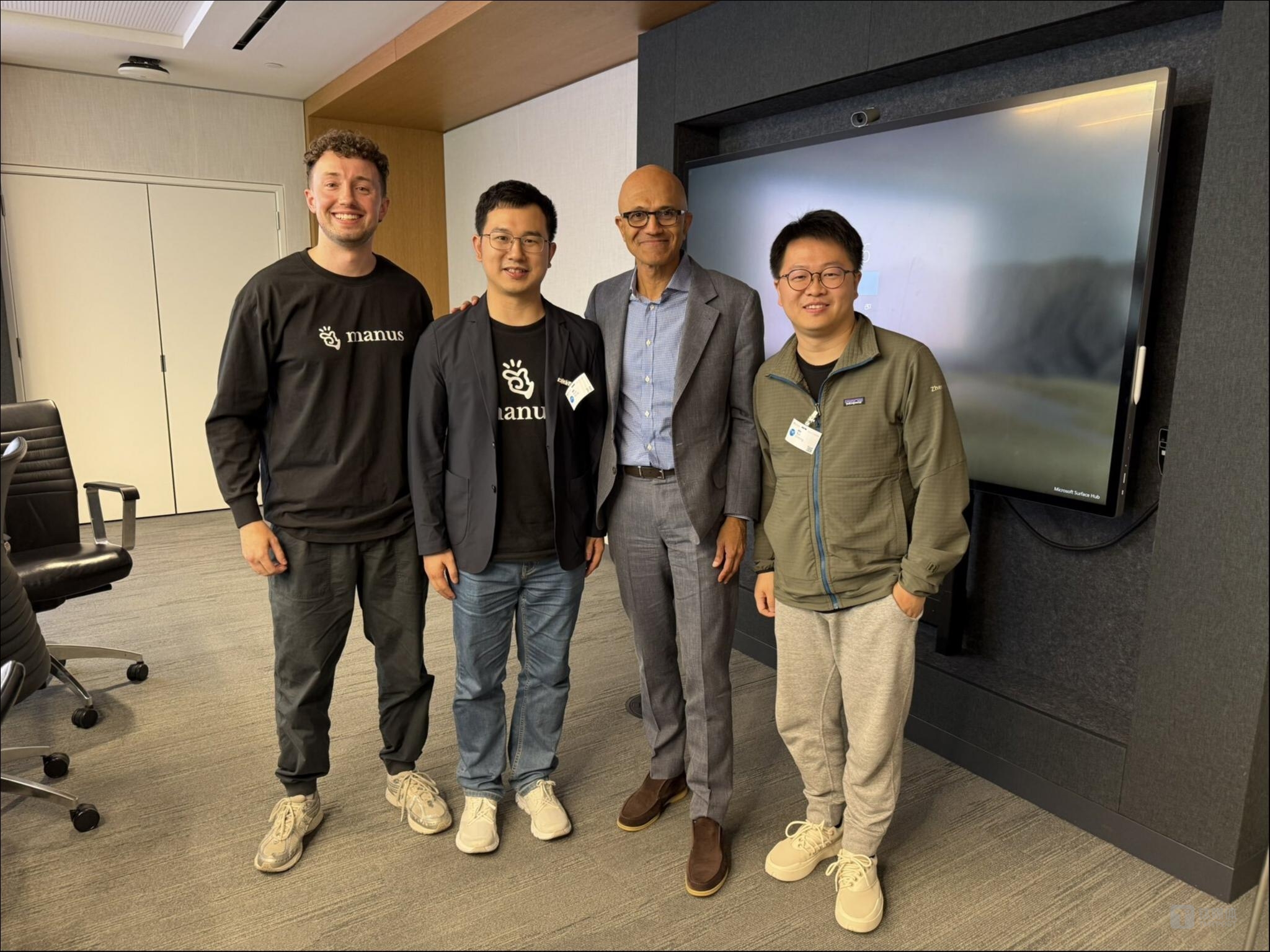

Founder Xiao Hong launched Manus in March 2025, branding it as the world’s first general-purpose AI agent capable of executing complex, dynamic tasks—not just answering queries, but directly delivering results. Built around the concept of “hand and brain” coordination, Manus can assist with tasks ranging from resume screening and stock analysis to real estate research. It gained attention for achieving state-of-the-art scores on the GAIA benchmark and was featured in a product integration with the Microsoft Store.

The product initially launched via invite-only access, with beta invitation codes being resold for up to RMB 100,000 on Chinese platforms like Xianyu. It later opened to the public in May, adding features such as slideshow generation and daily point incentives for users.

Manus’s domestic entity, Beijing Butterfly Effect Technology Co., Ltd., was founded in April 2022 by Xiao Hong. A second affiliated company, Beijing Red Butterfly Technology, was established in 2023 under the Hong Kong–registered Butterfly Effect Limited.

Manus’s overseas move is part of a broader trend among Chinese AI companies. HeyGen, an AI video generation startup founded by former Snap engineer Joshua Xu, relocated from Shenzhen to Los Angeles and asked its Chinese investors, including IDG Capital and Sequoia China, to sell their stakes to U.S. backers. Other examples include Singapore-based WIZ.AI, founded by ex-360 VP Lu Jianfeng, and U.S.-headquartered MainFunc, launched by former Baidu executive Jing Kun.

This shift reflects a response to the Biden administration’s 2024 executive order restricting U.S. investments in Chinese firms involved in AI, semiconductors, and quantum computing. The order took effect in January 2025 and continues to reshape the strategic choices of Chinese tech companies.

Singapore’s appeal lies in its favorable regulatory environment, strong computing infrastructure, and growing pool of AI talent. According to the Monetary Authority of Singapore, investment in the country’s AI sector surged 45% year-on-year in 2024. Successful cases such as Tabcut—another Chinese-founded AI company that raised $5.6 million after relocating to Singapore—have further validated the city-state as a rising hub for global AI innovation.

Analyst Shen Meng of Xiang Song Capital noted that AI Agent companies like Manus, which depend on access to various global LLMs, are more vulnerable to restrictions than those focused on model development. “Headquartering in China limits their ability to work with tools like OpenAI, Google Gemini, or Claude,” he said. “Singapore not only provides a neutral ground but also helps reinforce a global image.”

As of now, Manus has declined to comment on the specifics of its restructuring or the timeline for its fully localized Chinese version. Its official website still shows the Chinese-language product as “under development.”

The company’s recent moves signal a pivotal transformation—not only for its business model but also for how Chinese-born AI startups navigate an increasingly fragmented global tech landscape.

更多精彩内容,关注钛媒体微信号(ID:taimeiti),或者下载钛媒体App